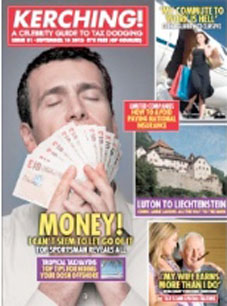

Ahead of next weeks Congress the TUC has published Kerching! – a celebrity gossip style magazine – aimed at embarrassing the Coalition government into taking action against celebrity and sports star tax dodgers.

Ahead of next weeks Congress the TUC has published Kerching! – a celebrity gossip style magazine – aimed at embarrassing the Coalition government into taking action against celebrity and sports star tax dodgers.

Kerching! A Celebrity Guide to Tax Dodging lists the top ten ways celebrities, sports stars and big corporations us to get around the rules. These include offshore trusts, use of Gift Aid and an extensive use of tax havens such as the Bahamas, Mauritius and Panama.

The 8 page magazine describes the ten steps George Osborne could take to tackle tax avoidance bringing in cash to the public coffers.Amongst the top ten tax-avoiding tips outlined for celebrities wanting to hide their cash

- Income that should be liable for tax in the UK can be put into an offshore company or trust in a tax haven like Liechtenstein. This income is then lent back to the tax-avoiding celebrity, who pays a small amount of interest but never actually settles the ‘loan’ in full. This way the superstar celebrity gets to stay living and working in the UK, but avoids paying tax on most of their income.

- Celebrity sports stars can avoid paying tax on income made from the use of their image rights. The money they receive for the use of these photos goes into companies the sports celebs own, and as a result they pay significantly less tax than they would have done had they been paid for the use of the images as part of their salary.

- Super-rich husbands or civil partners can abuse the tax system by making sure that income they themselves should be paying tax upon is paid to their wife or civil partner.

The UK’s tax residency rules are also used by celebrities and sports stars, says the TUC. Anyone spending less than 90 days a year in the UK can claim to be a non-resident, and because the definition of a day for tax purposes is open to interpretation, top earners can be in the UK for up to four days a week, 40 weeks a year, and still avoid paying tax.

TUC General Secretary Brendan Barber said: “The overwhelming majority of people in the UK have little choice over the amount of tax they pay and unlike big corporations and super-rich celebrities don’t have the means to employ expensive accountants to help them avoid paying their fair share of tax. The Chancellor has said he finds tax avoidance morally repugnant – so do we and that’s why we want him to act. Closing down the multiple loopholes which super-rich celebrities and their accountants jump through on a regular basis could make a huge difference to our public finances and take the pressure off the little people who are bearing the brunt of the government’s austerity measures.”

The ten simple steps the TUC’s says the government could take to crack down on tax avoidance include:

- The introduction of a new tax law – a general anti-avoidance principle – which would treat all tax avoidance as unacceptable, and which would be much stronger than the current change ministers are proposing.

- A halt to the current round of job cuts at HM Revenue & Customs so that there are enough staff and resources available to tackle the widespread degree of tax avoidance in the UK

-

Abolishing the domicile rule, putting the UK’s tax residence rules on a statutory basis, and reforming tax relief on charitable donations to stop abuse and ease the administrative burden on charities.

Not available in the shops! Download a copy of Kerching! by clicking on this link or on the graphic above.